Driving National Development

How we contribute to economies across our footprint

We have developed a strong presence across ASEAN and South Asia, where we contribute to sustainable economic development through the taxes we pay, jobs we provide and the digital ecosystems we support.

With a long-term outlook towards value creation, we invest significantly and consistently in network infrastructure, talent development, environmental conservation and in society across our markets of operation, helping the region’s emerging economies reach their full potential.

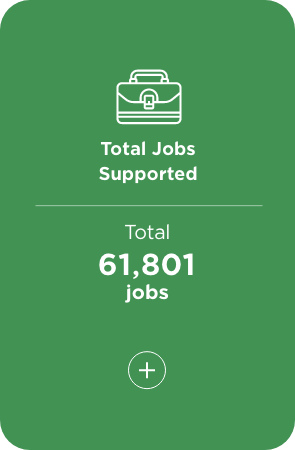

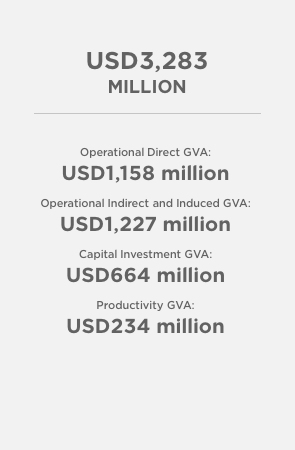

Investments in 2022:

USD912 million

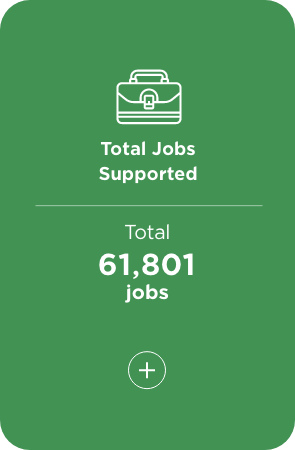

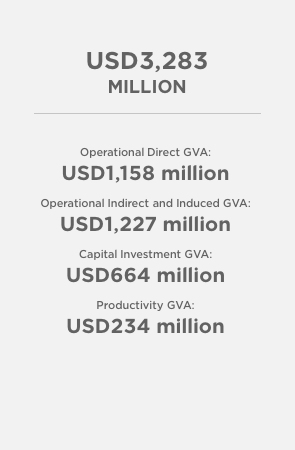

> 61,801 jobs supported

> 0.7% of Malaysia GDP in terms of GVA contribution

Investments in 2022:

USD1,809 million

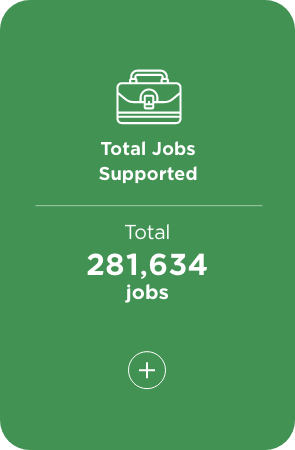

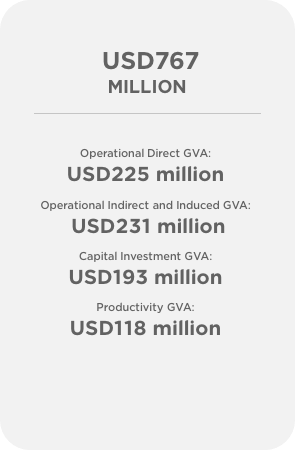

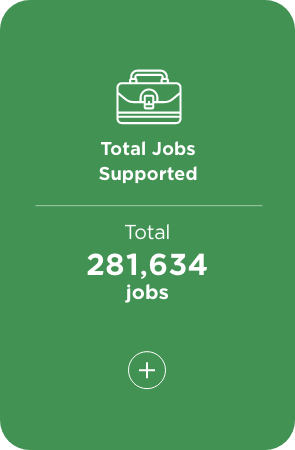

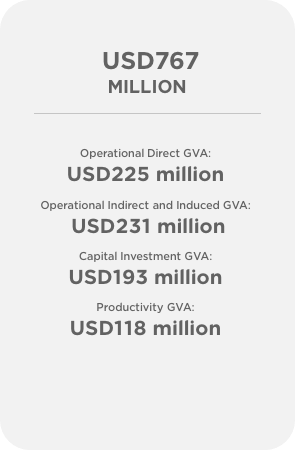

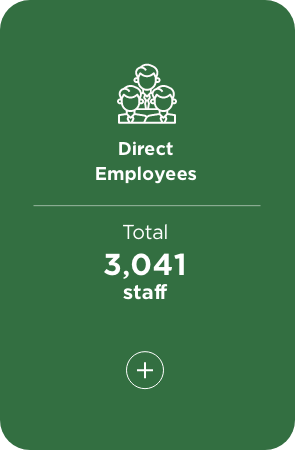

> 281,634 jobs supported

> 0.3% of Indonesia GDP in terms of GVA contribution

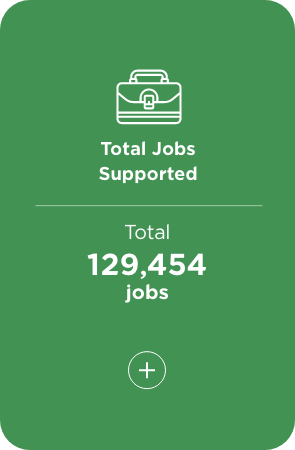

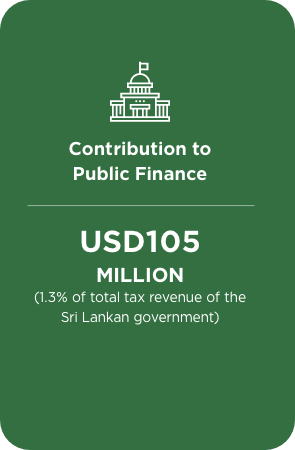

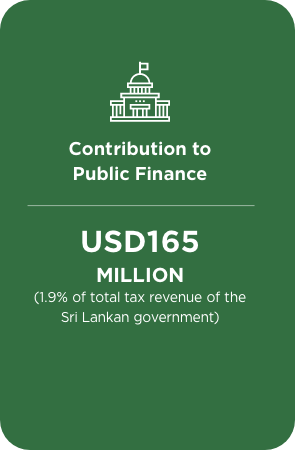

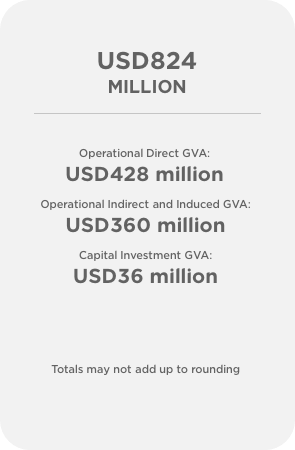

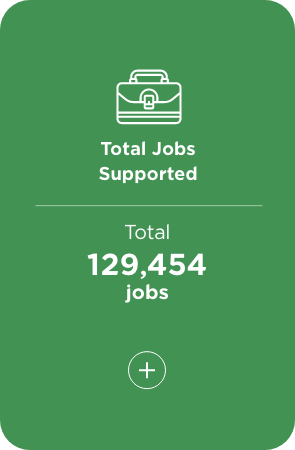

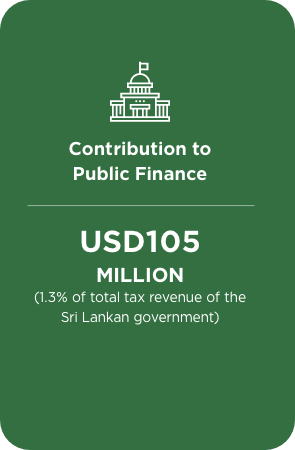

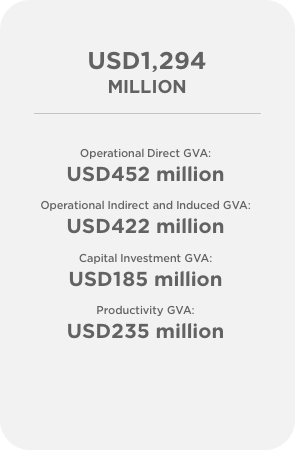

Investments in 2022:

USD631 million

> 129,454 jobs supported

> 0.9% of Sri Lanka GDP in terms of GVA contribution

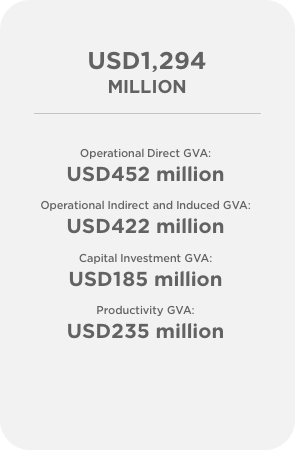

Investments in 2022:

USD670 million

> 109,539 jobs supported

> 0.4% of Bangladesh GDP in terms of GVA contribution

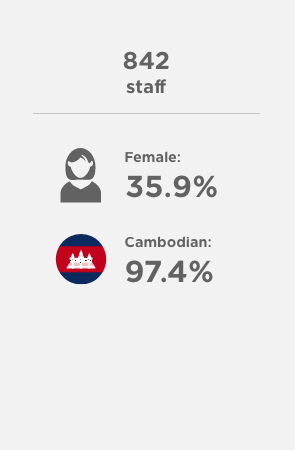

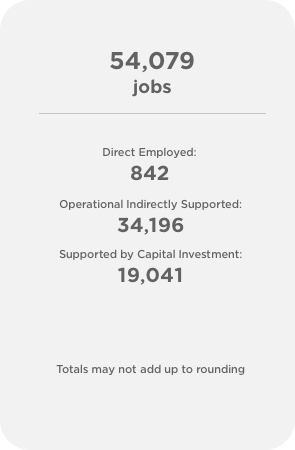

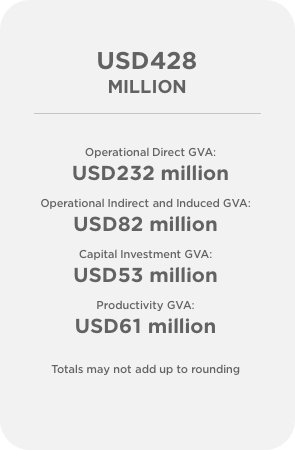

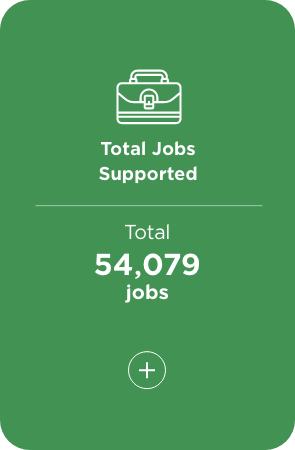

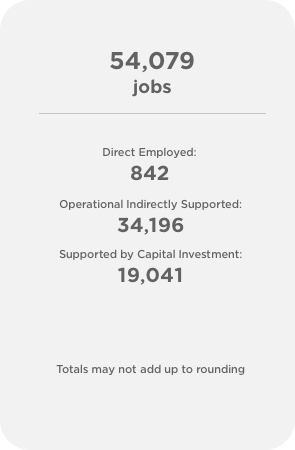

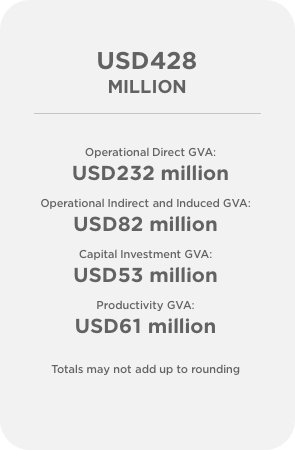

Investments in 2022:

USD255 million

> 54,079 jobs supported

> 1.3% of Cambodia GDP in terms of GVA contribution

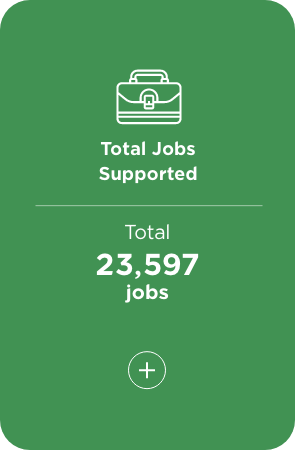

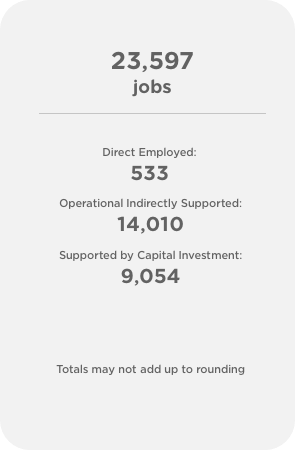

Investments in 2022:

USD183 million

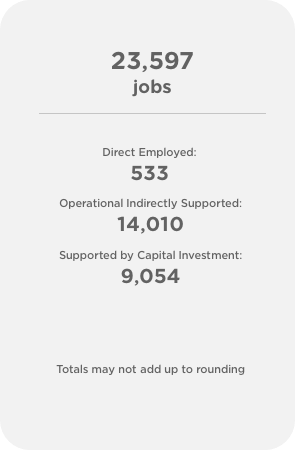

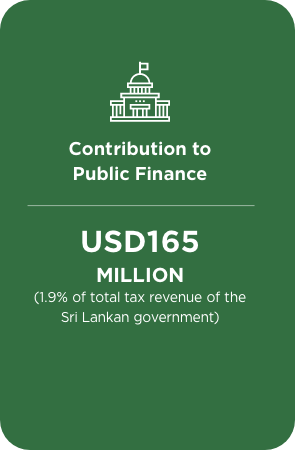

> 23,597 jobs supported

> 1.3% of Nepal GDP in terms of GVA contribution

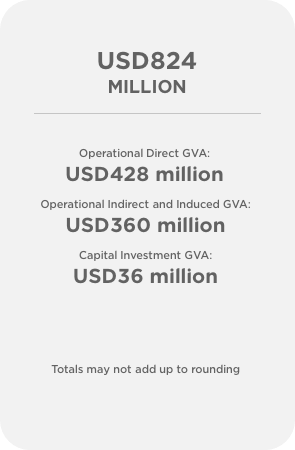

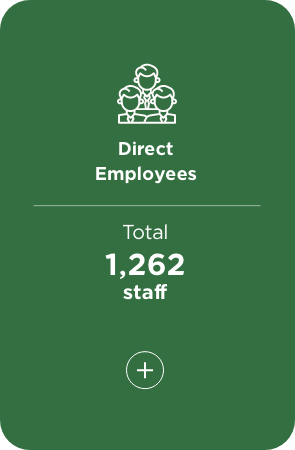

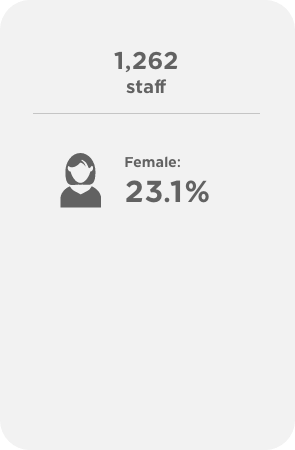

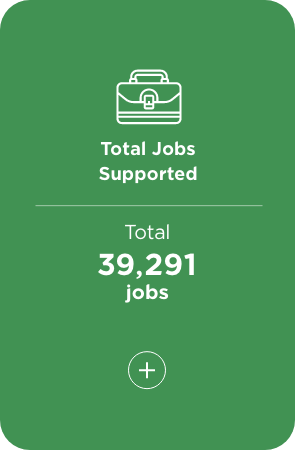

Investments in 2022:

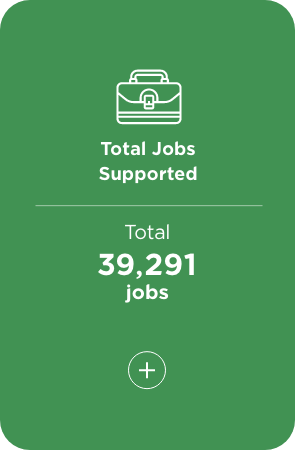

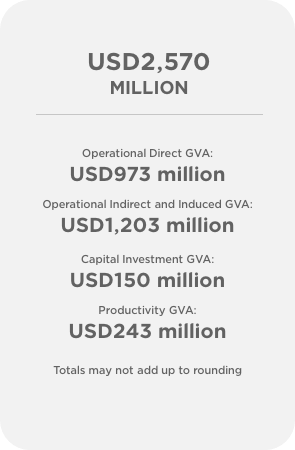

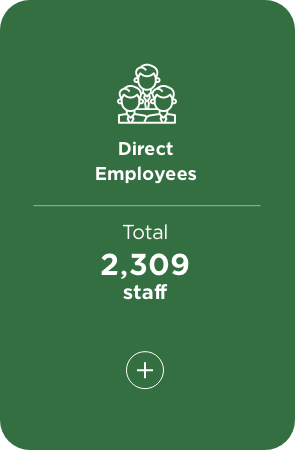

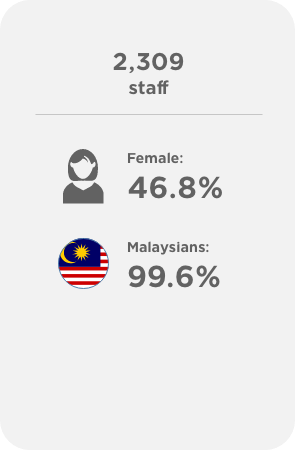

USD227 million

> 39,291 jobs supported

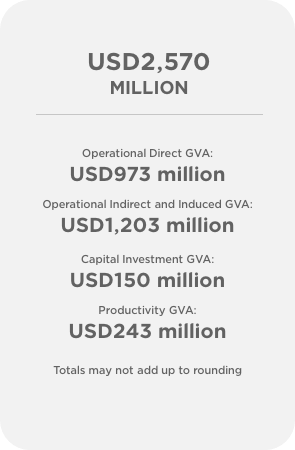

USD9.5

billion

GDP contributed

USD4.7

billion

CAPEX + OPEX

investment

USD1.5

billion

total taxes

and fees paid

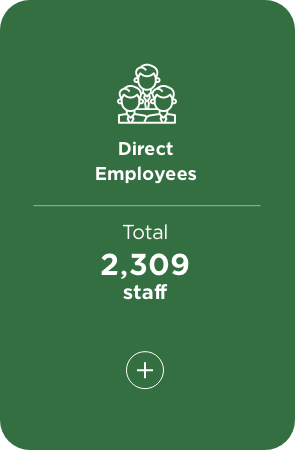

More than

11,500

employees across Asia

Supported around

700,000

jobs across Asia

*Measurement of economic impact and value creation in the markets and communities served by Digital Telcos and Infrastructure.

Investments in 2022:

USD912 million

> 61,801 jobs supported

> 0.7% of Malaysia GDP in terms of GVA contribution

Investments in 2022:

USD1809 million

> 281,634 jobs supported

> 0.3% of Indonesia GDP in terms of GVA contribution

Investments in 2022:

USD631 million

> 129,454 jobs supported

> 0.9% of Sri Lanka GDP in terms of GVA contribution

Investments in 2022:

USD670 million

> 109,539 jobs supported

> 0.4% of Bangladesh GDP in terms of GVA contribution

Investments in 2022:

USD255 million

> 54,079 jobs supported

> 1.3% of Cambodia GDP in terms of GVA contribution

Investments in 2022:

USD183 million

> 23,597 jobs supported

> 1.3% of Nepal GDP in terms of GVA contribution

Investments in 2022:

USD227 million

> 39,291 jobs supported

Our National Contributions

Discover our national contributions in 2022 below and download our Sustainability and National Contribution Report 2022 for greater detail on how we are driving national development.

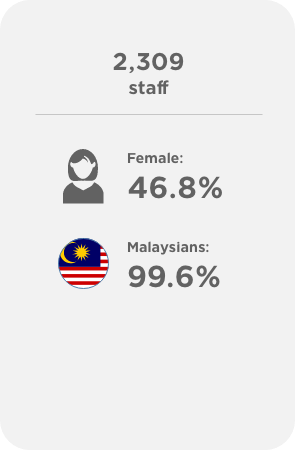

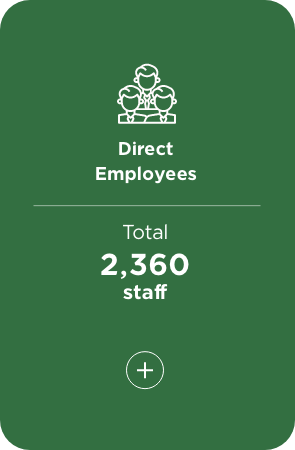

Celcom is Malaysia’s first private mobile operator, with over 9.4 million customers.

Established in 1988, Celcom’s national 2G and 4G networks cover over 96% of the population, and they have also solidified their innovation leadership in the enterprise segment. Driven by their relentless ‘customer-first’ strategy, Celcom continues to invest in network enhancement programmes, while simultaneously cultivating a more agile workforce and engaging with employees to ensure the success of the newly merged entities.

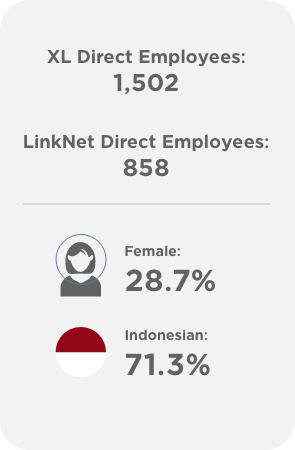

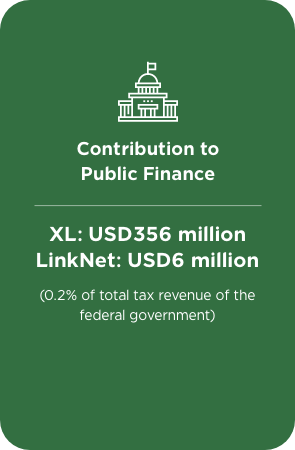

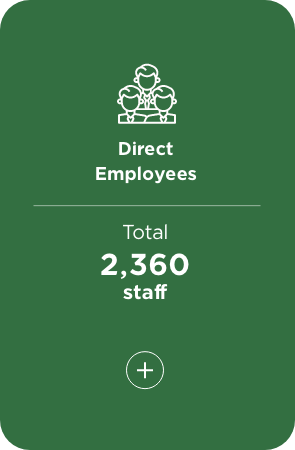

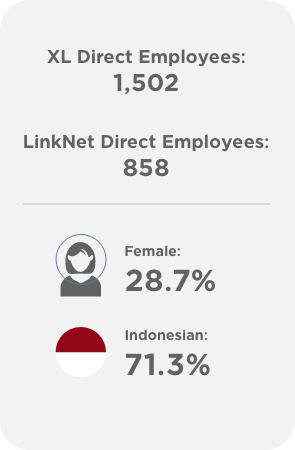

We are represented in Indonesia by XL Axiata and Link Net.

XL Axiata is the second largest telecommunications company in Indonesia by market capitalization, offering an array of innovative telecommunications products and services ranging from voice, SMS, Value Added Service (VAS) to mobile data. covering more than 92% of the population throughout Indonesia and boasting over 57.5 million subscribers.

Established in 2000, Link Net is one of the largest cable service providers in Indonesia, providing high-quality pay television services, high-speed broadband internet and data communications under “First Media” brand for residential customers and the “Link Net” brand for corporate customers, through which they collectively boast over 0.8 million customers.

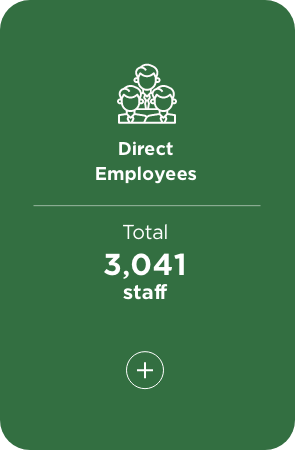

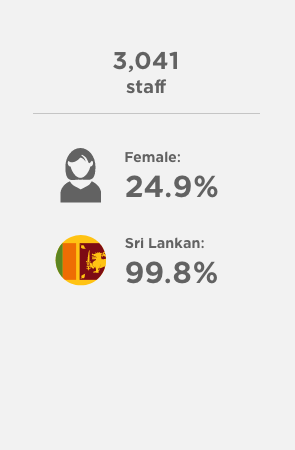

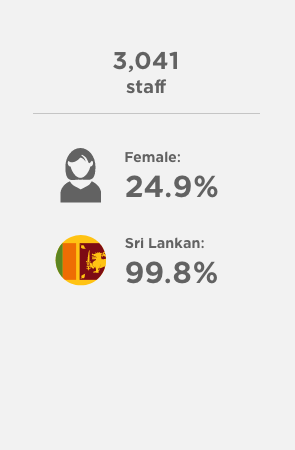

Dialog operates Sri Lanka’s largest and fastest growing mobile telecommunications network, serving over 17.4 million customers.

Dialog delivers advanced mobile telephony and high speed mobile broadband services, Fixed Telecommunications, and Digital Pay Television through its fully-owned subsidiaries, placing them at the forefront of innovation in the Sri Lankan mobile industry since the late 1990s. Today, they remain a positive force in Sri Lanka’s communities and the nation at large, amid the challenging economic conditions faced by the country.

Robi is the second largest mobile network operator in Bangladesh, serving more than 54.4 million customers.

Robi was the first company in Bangladesh to launch 4.5G service in all the 64 districts of the country and ended 2022 standing tall with more than half of its subscribers (53%) using 4G service. Today, close to 76% of their subscribers are data users, on which count they lead the industry by a long margin.

Smart is Cambodia’s leading mobile telecommunications operator, serving more than 7.1 million customers.

Sitting at the forefront of mobile technology advancement in Cambodia with extensive national wide coverage of approximately 99% of the population, Smart was the first network to introduce 4G LTE in 2014, 4G+ in 2016, 4G+ with HD Voice (VoLTE) and LTE Advanced Pro in 2017, before hosting the first 5G live showcase in the Kingdom in 2019. Looking forward, they are eager to support the Kingdom’s Digital Economy and Society Policy Framework 2021-2035.

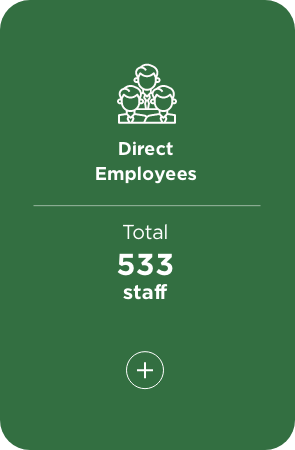

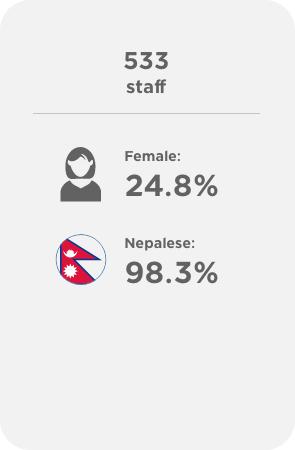

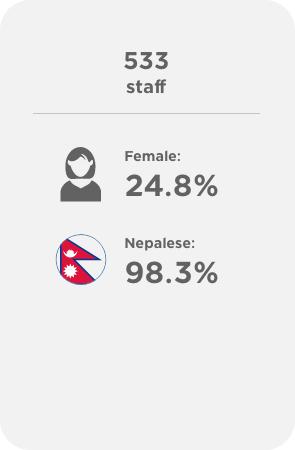

Ncell operates Nepal’s widest 4G network and serves 17.1 million customers, providing high-quality, modern and cost-effective services.

Today, Ncell continues to maintain its position as the market leader in terms of RMS, with a steady brand equity score that surpasses that of market players, as evidenced by their positive rNPS. This gives a solid foundation to move forward with optimism into 2023, as they work collaboratively to achieve strategic priorities as part of their Recovery & Resilience journey for 2023 and beyond.

*Ncell reports its financial year for the full 12 months between 16 July 2021 and 15 July 2022.

EDOTCO is the first and leading regional integrated telecommunications infrastructure services company in Asia, with a mission to provide reliable and accessible digital connectivity to all.

Specialising in end-to-end solutions in the tower services sector including co-locations, build-to-suit, energy, transmission and operations and maintenance (O&M), EDOTCO is the sixth largest global telecommunications TowerCo in the world as of 2022, boasting over 58,000 towers in their regional portfolio.

Our National Contributions

Discover our national contributions in 2022 below and download our Sustainability and National Contribution Report 2022 for greater detail on how we are driving national development.

Celcom is Malaysia’s first private mobile operator, with over 9.4 million customers.

Established in 1988, Celcom’s national 2G and 4G networks cover over 96% of the population, and they have also solidified their innovation leadership in the enterprise segment. Driven by their relentless ‘customer-first’ strategy, Celcom continues to invest in network enhancement programmes, while simultaneously cultivating a more agile workforce and engaging with employees to ensure the success of the newly merged entities.

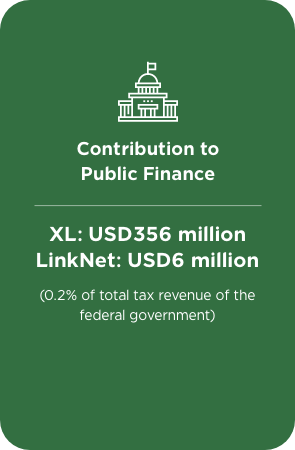

We are represented in Indonesia by XL Axiata and Link Net.

XL Axiata is the second largest telecommunications company in Indonesia by market capitalization, offering an array of innovative telecommunications products and services ranging from voice, SMS, Value Added Service (VAS) to mobile data. covering more than 92% of the population throughout Indonesia and boasting over 57.5 million subscribers.

Established in 2000, Link Net is one of the largest cable service providers in Indonesia, providing high-quality pay television services, high-speed broadband internet and data communications under “First Media” brand for residential customers and the “Link Net” brand for corporate customers, through which they collectively boast over 0.8 million customers.

Dialog operates Sri Lanka’s largest and fastest growing mobile telecommunications network, serving over 17.4 million customers.

Dialog delivers advanced mobile telephony and high speed mobile broadband services, Fixed Telecommunications, and Digital Pay Television through its fully-owned subsidiaries, placing them at the forefront of innovation in the Sri Lankan mobile industry since the late 1990s. Today, they remain a positive force in Sri Lanka’s communities and the nation at large, amid the challenging economic conditions faced by the country.

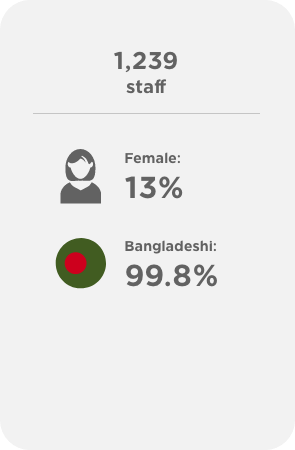

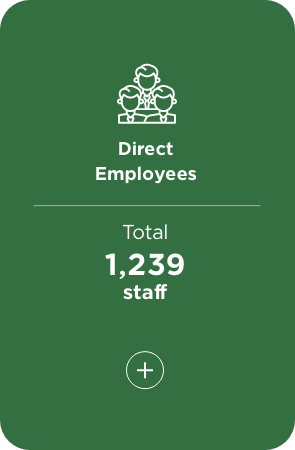

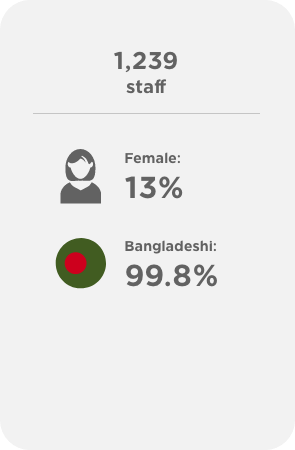

Robi is the second largest mobile network operator in Bangladesh, serving more than 54.4 million customers.

Robi was the first company in Bangladesh to launch 4.5G service in all the 64 districts of the country and ended 2022 standing tall with more than half of its subscribers (53%) using 4G service. Today, close to 76% of their subscribers are data users, on which count they lead the industry by a long margin.

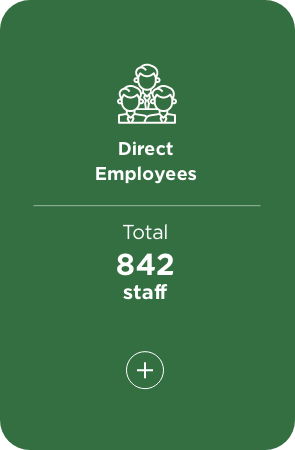

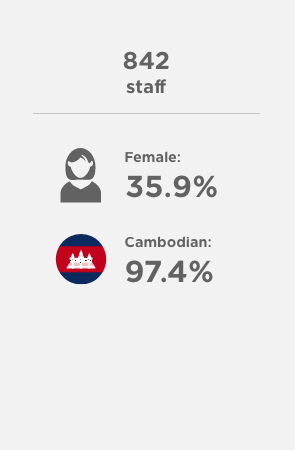

Smart is Cambodia’s leading mobile telecommunications operator, serving more than 7.1 million customers.

Sitting at the forefront of mobile technology advancement in Cambodia with extensive national wide coverage of approximately 99% of the population, Smart was the first network to introduce 4G LTE in 2014, 4G+ in 2016, 4G+ with HD Voice (VoLTE) and LTE Advanced Pro in 2017, before hosting the first 5G live showcase in the Kingdom in 2019. Looking forward, they are eager to support the Kingdom’s Digital Economy and Society Policy Framework 2021-2035.

Ncell operates Nepal’s widest 4G network and serves 17.1 million customers, providing high-quality, modern and cost-effective services.

Today, Ncell continues to maintain its position as the market leader in terms of RMS, with a steady brand equity score that surpasses that of market players, as evidenced by their positive rNPS. This gives a solid foundation to move forward with optimism into 2023, as they work collaboratively to achieve strategic priorities as part of their Recovery & Resilience journey for 2023 and beyond.

*Ncell reports its financial year for the full 12 months between 16 July 2021 and 15 July 2022.

EDOTCO is the first and leading regional integrated telecommunications infrastructure services company in Asia, with a mission to provide reliable and accessible digital connectivity to all.

Specialising in end-to-end solutions in the tower services sector including co-locations, build-to-suit, energy, transmission and operations and maintenance (O&M), EDOTCO is the sixth largest global telecommunications TowerCo in the world as of 2022, boasting over 58,000 towers in their regional portfolio.